Revenue Operations Analyst Assessment

- Determine the commission earned by each of the four Account Executives, all of whom are on annual compensation plans with commission-based structures. Commission rates is calculated based on their Revenue attainment percentage at the time of booking. Details on Quota and Plan is on Tab “Commission Rate and Quota”.

- Please input commission rate and commission earned in Columns K and L on the Data Tab.

- Please list total commission by rep by Product and Service

- What insights can be drawn from this data?

- Benjamin Lee is challenging their commission, claiming that you miscalculated. Describe how you would you validate the claim, communicate with Account Executive, and document the resolution process.

- Prepare 1 to 3 slides summarizing your assessment and proposed recommendations. Your slides should address:

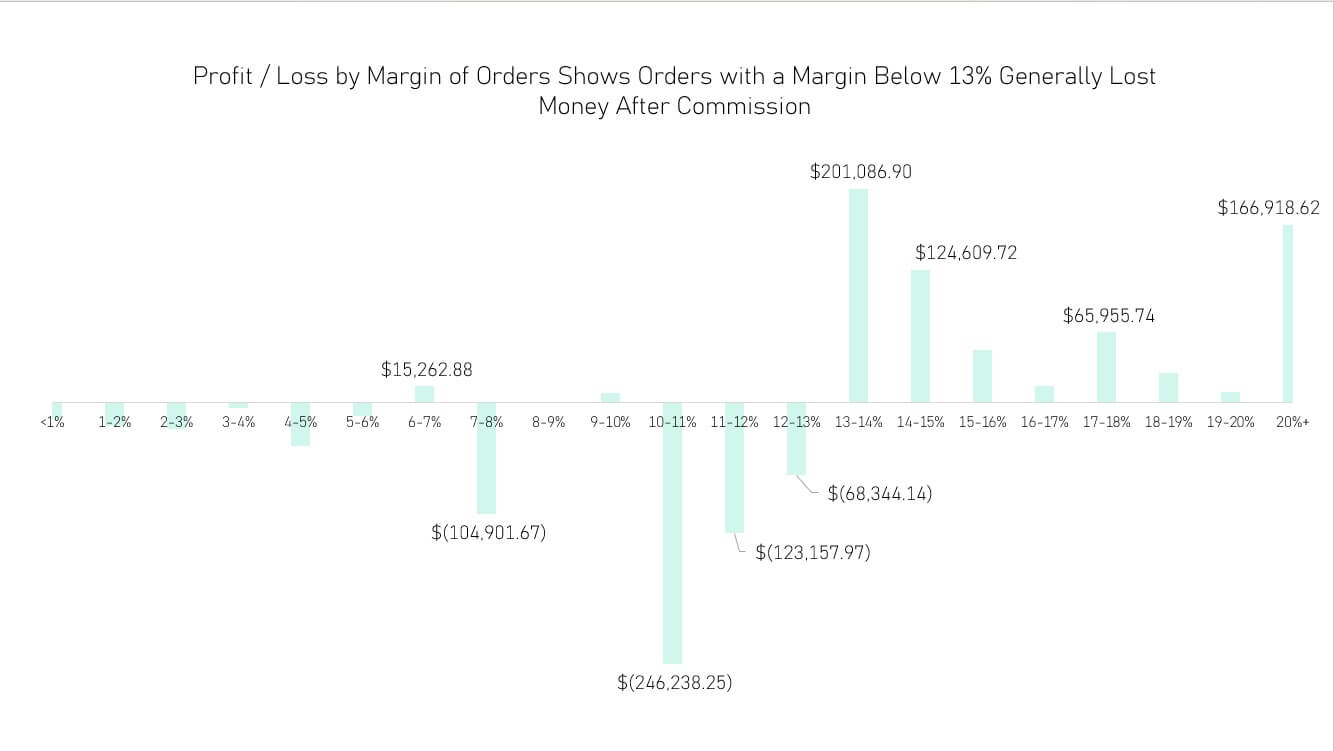

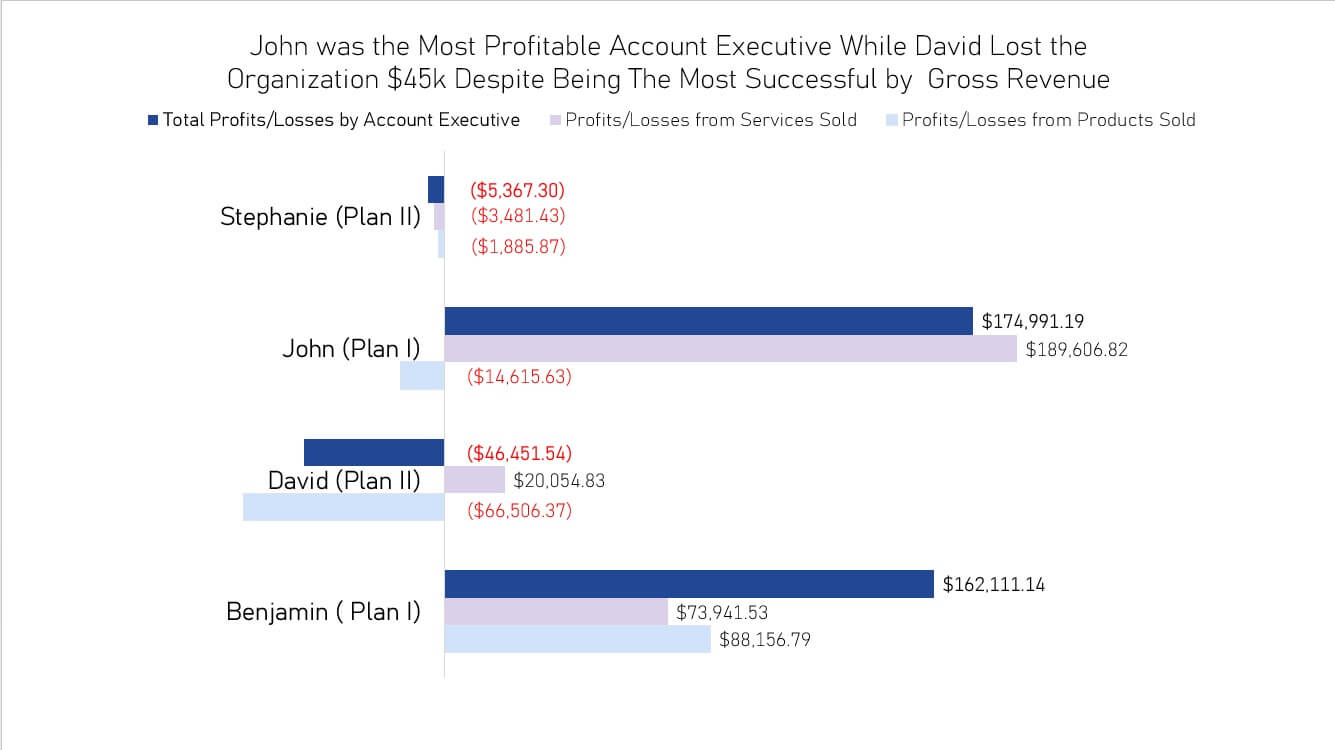

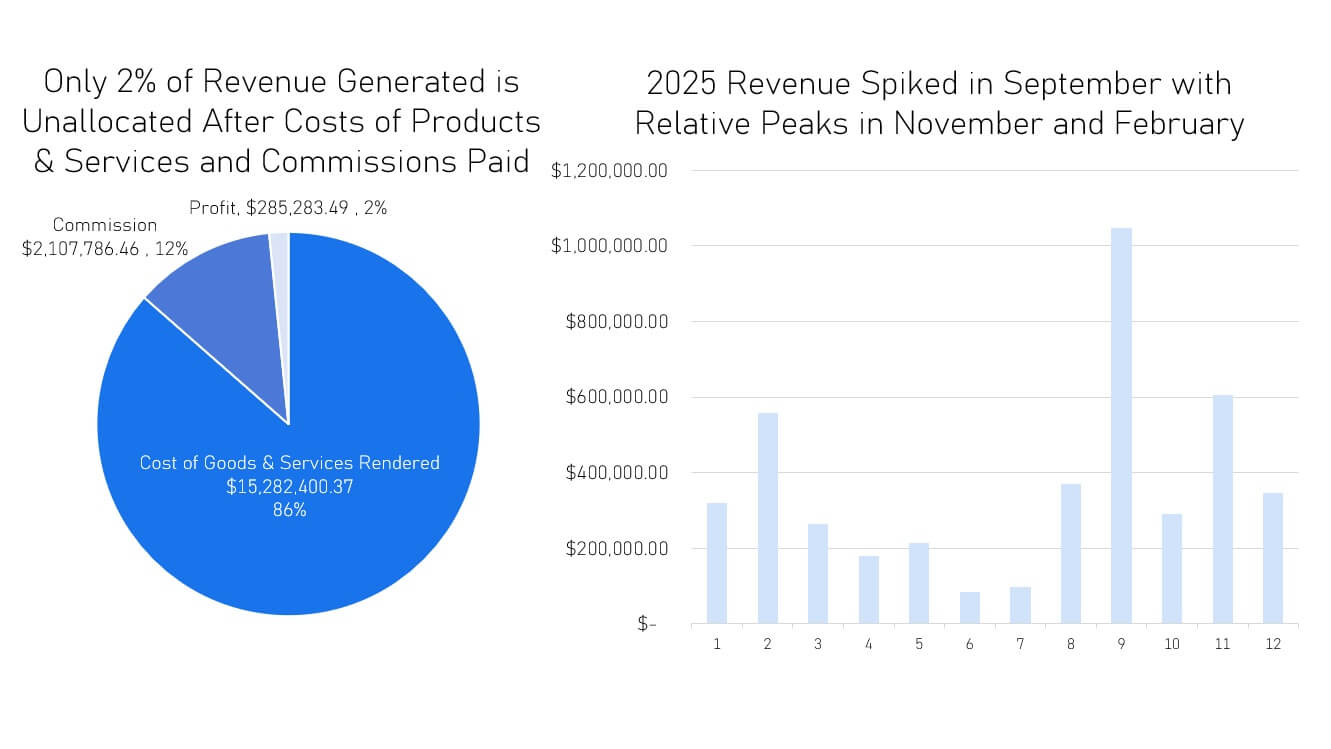

Key Observations:

- Any concerns or inefficiencies in the existing plan

- Recommended changes (if any) and the rationale behind them

- Potential impact on behavior and company goals

You may use visuals, charts or data summaries to support your recommendations.

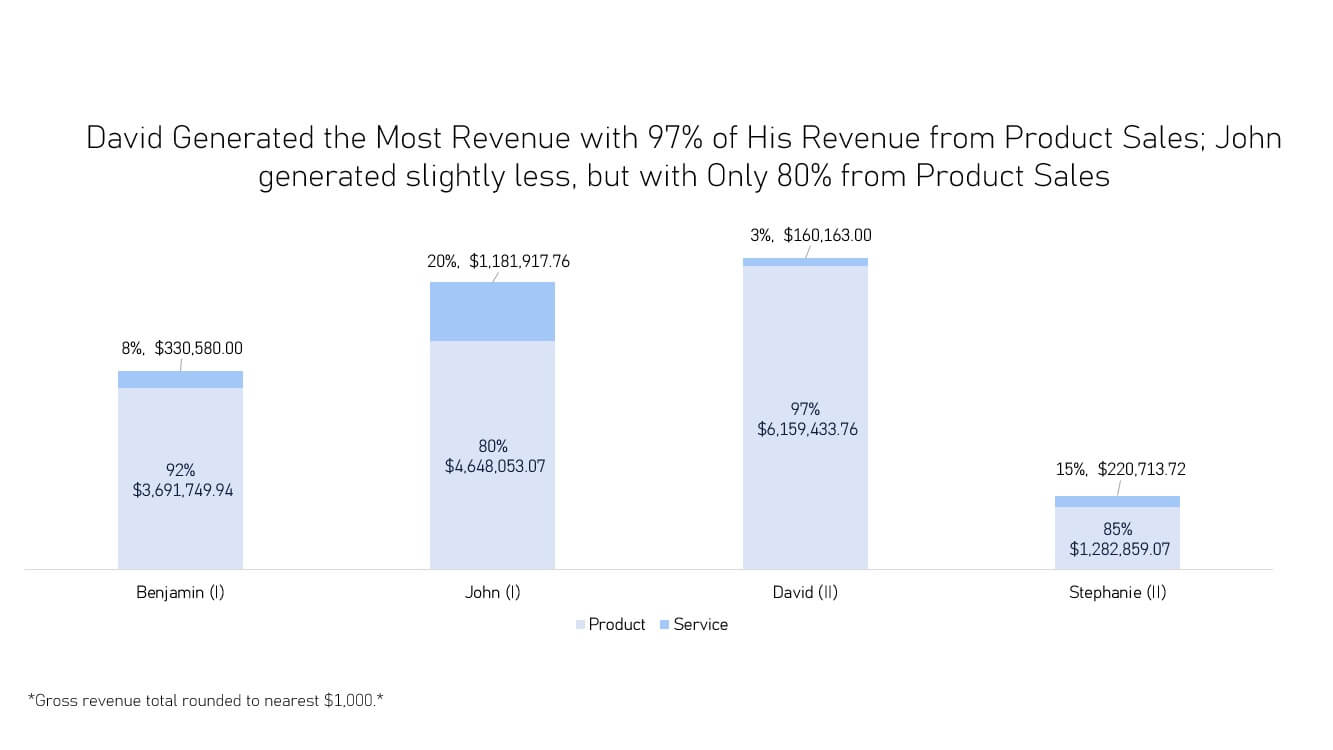

| Account Executive | Plan | Product Quota | Service Quota |

|---|

| Benjamin Lee | Plan I | 2,953,399 | 247,935 |

| David Jones | Plan II | 3,695,661 | 115,317 |

| John Smith | Plan I | 3,486,039 | 827,342 |

| Stephanie Jones | Plan II | 833,858 | 143,463 |

| Plan I | Commission Rates |

|---|

| Attainment % TIERS | PRODUCT | SERVICE |

| 0% | 50% | 7% | 10% |

| 50% | 75% | 9% | 13% |

| 75% | 90% | 10% | 14% |

| 90% | 100% | 16% | 23% |

| 100% | 125% | 18% | 25% |

| 125% | END | 20% | 28% |

| Plan II | Commission Rates |

|---|

| Attainment % TIERS | PRODUCT | SERVICE |

| 0% | 50% | 5% | 8% |

| 50% | 75% | 7% | 11% |

| 75% | 90% | 8% | 12% |

| 90% | 100% | 14% | 21% |

| 100% | 125% | 16% | 23% |

| 125% | END | 18% | 26% |